Maximizing Your Wealth: Understanding Capital Gains Tax & Strategic Investment Opportunities

As we approach the end of 2023, it’s crucial to address a significant aspect of your financial strategy: capital gains tax. At Perry CPA and Coastal Way Financial, we believe in optimizing your finances, and there’s still time to KEEP a substantial portion of your earnings through strategic investments. And if you act now, you can even increase those earnings.

In the article below, we explain how and what to do today.

Understanding Capital Gains Tax

In simple terms, capital gains tax is the levy imposed on the profit earned from the sale of assets or investments, such as stocks, real estate, or other valuable holdings. When these assets are sold at a profit, the resulting gain is taxable. However, there are strategies available to minimize these taxes, preserving more of your hard-earned money.

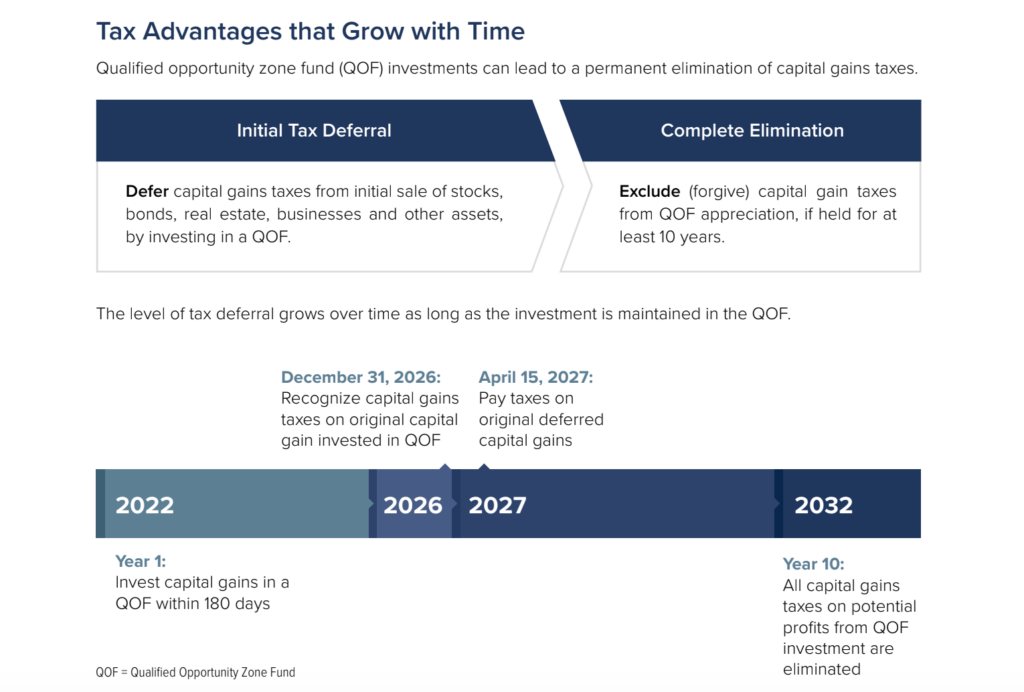

Take a look at a diagram from this year to see if this applies to you. There are also various other factors to consider like which state you live in but that is where we come in.

Opportunities for Tax Savings

We’re excited to announce strategic partnerships that enable us to offer various alternative investment opportunities to those who qualify. These opportunities, including strategies like 1031 exchanges & quaIified opportunity zones, which present avenues to mitigate capital gains tax. They provide a pathway for investors to defer tax payments and potentially redirect those funds into new investments, fostering continued financial growth.

How 1031 Exchanges Work

Imagine you’ve made a sizable profit from the sale of an investment property. Instead of immediately paying capital gains tax, a 1031 opportunity zone allows you to reinvest the proceeds into a qualified opportunity zone fund. This deferment increases your overall investment returns. This deferred tax payment can then be redirected into another investment opportunity, providing a potential double benefit—tax savings.

This strategic move is not just about deferring taxes; it’s about leveraging your earnings to generate further wealth while retaining more of your profits.

This is just the beginning!

2024 holds our promise of an extensive initiative designed to further maximize your income and wealth. Join our newsletter below to stay updated on the latest strategies and insights that can propel your financial success to new heights.

Stay ahead of the curve and catapult your income in 2024!

Book a Call Today

Take the first step toward securing your financial future by booking a call with our team. Let’s explore how these strategic partnerships and many alternative investment opportunities can work in your favor.

Seize the opportunity today to proactively manage your taxes and investments for a more prosperous tomorrow.