How to Avoid State Income Taxes on Signing Bonuses for Athletes

In the competitive world of sports, understanding the nuances of financial management is as crucial as athletic performance, especially when it comes to managing state income taxes on signing bonuses. Athletes signing with teams in states that have high income tax rates can save a significant amount of money with proactive tax planning and the right contract language. Here’s how you can potentially avoid state income taxes on a “true” signing bonus.

The Importance of Residency and Contract Language

A “true” signing bonus is distinct in that it is earned immediately upon signing a contract, rather than being considered as earned based on the number of duty days or games played in various states. The key here is the residency of the athlete. For example, an athlete with residency in Florida—a state with no income tax—who signs with a team in a high-tax state like California, can avoid California state taxes on their signing bonus with the correct contract terms.

Crafting the Right Contract

The contract must explicitly state that the signing bonus is a “true” signing bonus, which means it is earned upon signing and is non-refundable without any stipulations. This specific language prevents the bonus from being considered as regular income earned over the period of the contract, which typically would be taxable in the state where it’s earned.

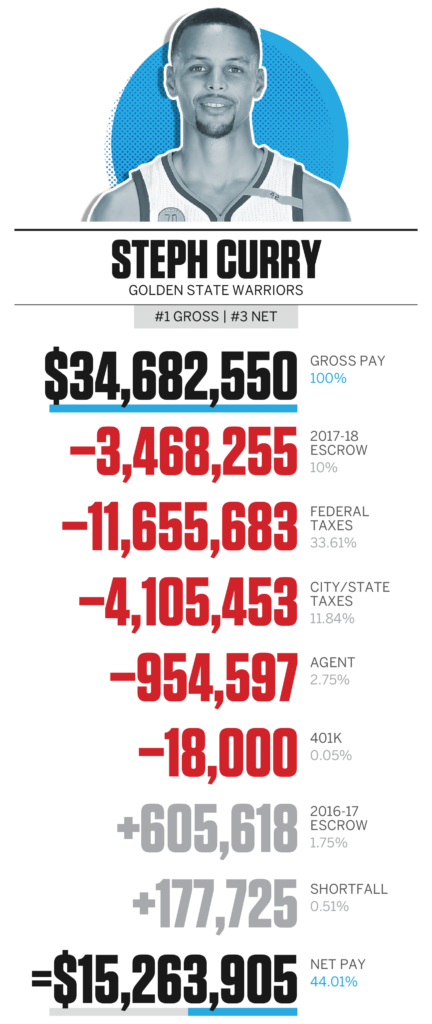

Let’s consider a hypothetical scenario where a player signs with a California team and receives a $5 million signing bonus. With proper contract language, this bonus would be managed under the tax laws of the athlete’s resident state (Florida in this case), thus avoiding California’s 13.3% state income tax. The savings? Over $600,000 in state income taxes.

Pitfalls to Avoid

Standard contract language might stipulate that the signing bonus must be repaid under certain conditions, such as failing to meet performance milestones or early termination of the contract. In such cases, the bonus may not qualify as a “true” signing bonus and would be subject to state income taxes where it’s earned, primarily impacting the total net amount received by the athlete.

Seeking Professional Advice

The complexities of such financial arrangements make it essential for athletes to work with a sports taxation specialist. These professionals can ensure that the contract language aligns with state requirements and maximizes the financial benefits of signing bonuses.

In conclusion, while athletes focus on their sports performance, understanding and planning for the financial impact of contract terms can lead to significant tax savings. By ensuring the right residency and contract terms, athletes can effectively manage their earnings and reduce their tax liabilities, keeping more of their hard-earned money. If you’re an athlete or represent one, consider reaching out to a sports taxation specialist to navigate these waters effectively. Don’t let tax concerns distract you from your game—plan ahead and play smarter, both on and off the field.